direct pay irs

IRS Direct Pay only accepts individual tax payments. Fourth Stimulus Check Update.

Direct Pay Help Internal Revenue Service

Cuenta bancaria Direct Pay.

. To make a 2021 estimated tax payment under the extended timeline for Hurricane Ida victims choose Balance Due as your payment option in Direct Pay. We accept full and partial payments including payments toward a payment plan including installment agreement. Click image for FAQs on IRS Direct Pay.

Let your clients know they can now pay their tax bills directly from their checking or savings accounts using IRS Direct Pay. IRS Direct Pay Now Available on IRSgov. But unlike EFTPS Direct Pay is available without having to pre-register.

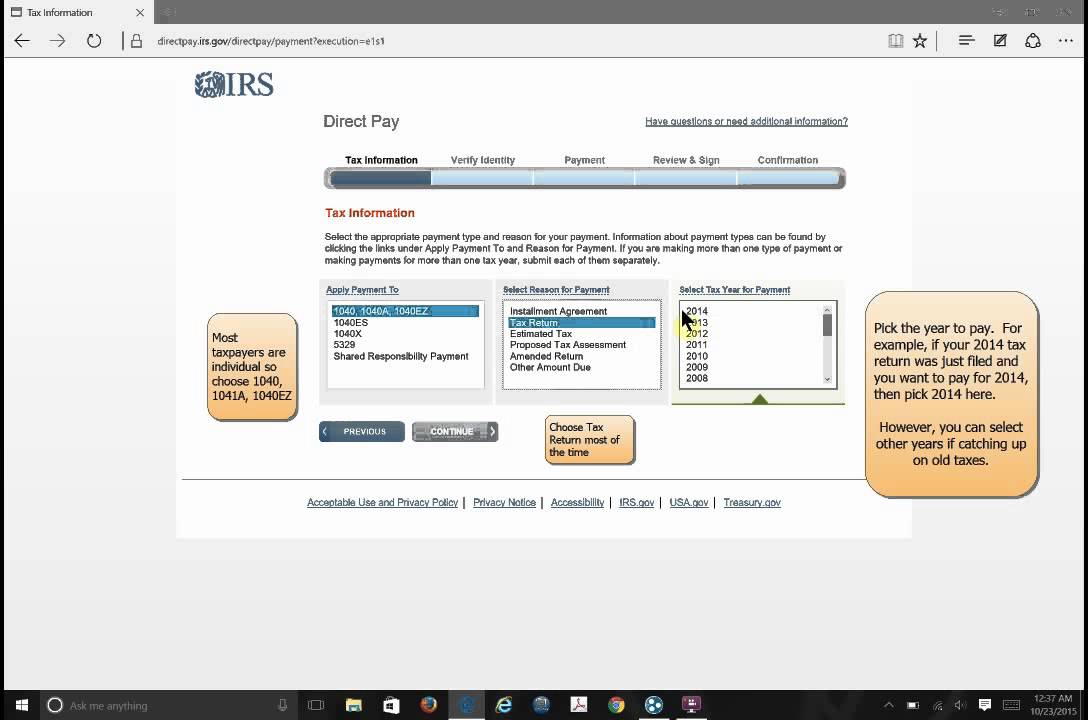

Direct Pay - Pay Your Federal and State Taxes Online Below are links for online payment to the IRS Maryland Virginia Pennsylvania and Washington DC. A variety of tax payments can be made at Direct Pay. You cannot schedule multiple or recurring payments though thats because IRS Direct Pay does not save your bank account information.

I gave as a reason for payment Tax Return or Notice. Id like to enter into TurboTax this tax payment but I dont see how to do so. IRS Direct Pay will continue to make content accessible for users using assistive technology in an effort to serve the needs of all who visit our application.

And also like EFTPS Direct Pay will take money from your designated checking or savings account to cover your tax bill. It is a free IRS service that lets you make tax payments online directly from your bank account to the IRS Internal Revenue Service. Its secure free of charge and available on IRSgov.

Para pagos electrónicos mayores utilice el Sistema de Pago Electrónico del Impuesto Federal EFTPS por sus siglas en inglés o el giro del mismo día. The Direct Pay difference. You can only use this payment lookup to research payments made through IRS Direct Pay.

Its the official IRS app available through the Amazon App Store the Apple App Store or Google Play. You can set up an electronic funds transfer from your checking or savings account through the Direct Pay on the IRS website if you have the money on hand to pay what you owe. You can also access Direct Pay on the IRS2Go mobile app.

Your SSN or ITIN is required in order to authorize your payment. To enroll or for more information taxpayers should visit EFTPSgov or call 800-555-4477. Social Security Number SSN Your S S N or I T I N is required in order to authorize your payment.

Page Last Reviewed or Updated. For larger electronic payments use EFTPS or same-day wire. For users who are blind or who have visual impairments the IRS Direct Pay application was designed to be accessible with most industry-standard screen readers.

You have reached the maximum number of allowable payments. There are several ways to make an IRS payment. Instant confirmation IRS Direct Pay gives you instant confirmation when.

Find Out Today If You Qualify. Joe Biden Wants to Send More Direct Payments to Americans in 2022. For security purposes we suggest that you close your browser.

You can visit Make a Payment page for alternative payment methods or come back later and try again. Schedule payments in advance IRS Direct pay allows taxpayers to schedule payments up to 30 days in advance. IRS Direct Pay a free and secure way for individual taxpayers to pay tax bills and make estimated tax payments directly from their bank accounts.

For more information please visit the. I dont want an extension. The IRS will give taxpayers instant confirmation when they submit their payment.

1 Make an IRS payment online. I havent yet filed my TurboTax-based return for 2019. 3 Where to mail IRS payments.

Note that your tax payment is due regardless of IRS Direct Pay online availability. Original and amended tax return balance due. This system simplifies the tax payment process where taxpayers with a computer with access to the internet can conveniently use it from home.

If you dont see your state listed send us an email and well provide you with a link to your states online payment option if it is available. IRS Direct Pay is a web-based system available on the IRS website wwwirsgov. With IRS Direct Pay.

2000 Monthly Payment Petition Hits Goal. Acceptable Use and Privacy Policy. Form 1040 Individual Income Tax Return.

IRS Direct Pay wont accept more than two payments within a 24-hour period and each payment must be less than 10 million. 2000 Stimulus Check Payment Petition Adds 1 Million. 2 Make an IRS payment with a check or money order.

This month I used IRS Direct Pay to make a tax payment for 2019. I see the Tax Payments Worksheet but I dont see where to put it. Extension Make a full or partial payment on your taxes in order to receive an extension without filing Form 4868 Application for Automatic Extension of Time to File for US.

Direct Pay del IRS no acepta más de dos pagos dentro de un período de 24 horas y cada pago debe ser menor de 10 millones. This website is experiencing technical difficulties. Please try again later.

Online With Direct Pay. End of modal content. Like EFTPS Direct Pay is a free online payment system.

Ad Do You Have IRS Debt Need An IRS Payment Plan.

Irs Gives Taxpayers One Day Extension After Payment Site Crashes Cnet

Irs Direct Pay One Of Many Ways To Pay Estimated Taxes Don T Mess With Taxes

Irs Direct Pay Option Not Working On Tax Day Youtube

Irs 1040es Estimated Tax Payment Online Using Direct Pay

Irs Payment Options How To Make Your Payments

Irs Direct Pay One Of Many Ways To Pay Estimated Taxes Don T Mess With Taxes

0 Response to "direct pay irs"

Post a Comment